How to Plan Annual Open Enrollment for Medication Coverage in Medicare

Dec, 23 2025

Dec, 23 2025

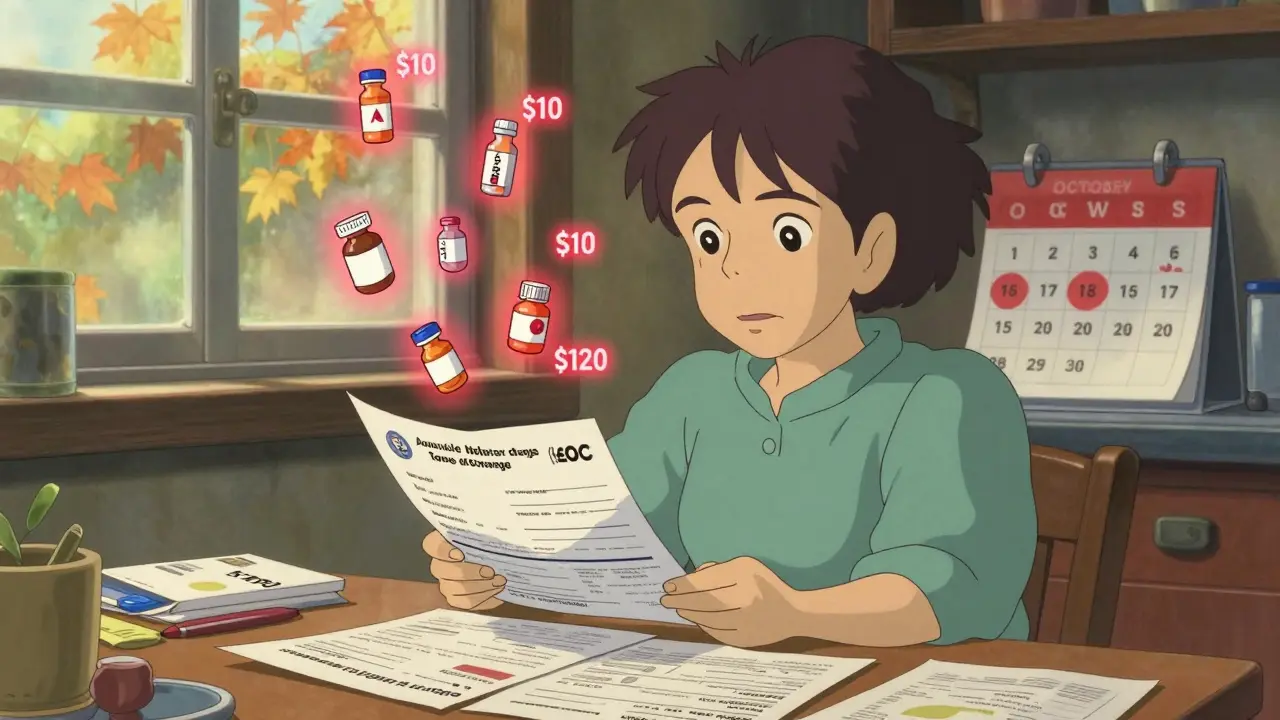

Every year, millions of Medicare beneficiaries miss out on hundreds - sometimes over a thousand - dollars in savings just because they don’t check their medication coverage. If you take regular prescriptions, skipping your Annual Open Enrollment Period (AEP) is like leaving money on the table. Your current plan might have covered your insulin at $10 a month last year, but this year? It’s now a specialty tier drug with a $120 co-pay. That’s not a fluke. It happens. And it’s completely avoidable.

Know the Dates - And Stick to Them

Medicare’s Annual Open Enrollment Period runs from October 15 to December 7 every year. That’s it. If you don’t make a change by December 7, your coverage for 2026 stays exactly as it was in 2025. No extensions. No grace period. No second chances. Changes you make during this window take effect on January 1 - no delays, no exceptions.

This window exists for one reason: plans change. Every single year. Premiums go up. Formularies get rewritten. Pharmacies drop out of networks. What was covered under Tier 2 last year might be Tier 4 this year - meaning your out-of-pocket cost could jump by 30% or more. The Centers for Medicare & Medicaid Services (CMS) reports that about 60% of Part D plans change at least one medication’s coverage status annually. If you don’t look, you won’t know.

Start with Your Current Plan’s Paperwork

Don’t jump straight into comparing plans. Start with what you already have. Look for two documents: the Annual Notice of Change (ANOC) and the Evidence of Coverage (EOC). These arrive in your mailbox around September 30. If you haven’t gotten them by October 10, call your plan directly or log into your account on Medicare.gov.

The ANOC lists every change your plan made for the coming year - premium increases, new deductibles, changes to your drug list, pharmacy network updates. The EOC is the full rulebook: what’s covered, what’s not, how much you pay, and what restrictions apply. Look for three things:

- Any medication you take that’s been moved to a higher tier

- Any medication that’s been removed from the formulary entirely

- Any new prior authorization or step therapy requirements

For example, if you take Ozempic or another GLP-1 drug, check if your plan now requires you to try cheaper alternatives first (step therapy). If they do, and you can’t get an exception, you could be stuck paying full price - over $1,000 a month - until you switch plans.

Use the Medicare Plan Finder Tool - With Your Exact Medications

Go to Medicare.gov/plan-compare. This is the only tool you need. Don’t rely on insurance agents or third-party websites. CMS runs this tool, and it pulls real-time data from every plan in your area.

Here’s how to use it right:

- Enter your ZIP code.

- Input every medication you take - including dosage and frequency. Don’t guess. Use the exact name your pharmacist uses.

- Select "Include Part D plans" and "Include Medicare Advantage plans with drug coverage."

- Click "Find Plans."

The tool will show you a side-by-side breakdown of each plan’s total estimated cost for your specific drugs in 2026. Look at the "Total Annual Cost" column - not just the monthly premium. A plan with a $0 premium might cost you $1,200 more a year in co-pays because your drugs are on a higher tier.

Pro tip: Filter by "Preferred Pharmacy." If you use CVS, Walgreens, or your local independent pharmacy, make sure they’re in the preferred network. Out-of-network pharmacies can charge you double.

Check Your Pharmacy Network - Don’t Assume It’s the Same

In 2024, 78% of Medicare Advantage plans changed their provider networks. That includes pharmacies. You might have been paying $15 for your blood pressure pill at your neighborhood CVS last year. This year? CVS is no longer in-network. Now you have to drive 12 miles to a different pharmacy - and pay $45.

Use the Plan Finder tool to search for your pharmacy by name. If it’s not listed as preferred, you’re paying more. Some plans even have tiered networks: Preferred, Standard, and Out-of-Network. Preferred pharmacies give you the lowest cost. Standard? Higher. Out-of-network? You might pay full retail price.

If your pharmacy is dropping out, find out which other pharmacies are preferred. Call them. Ask if they can fill your prescriptions. Some offer mail-order options with free shipping - which could save you even more.

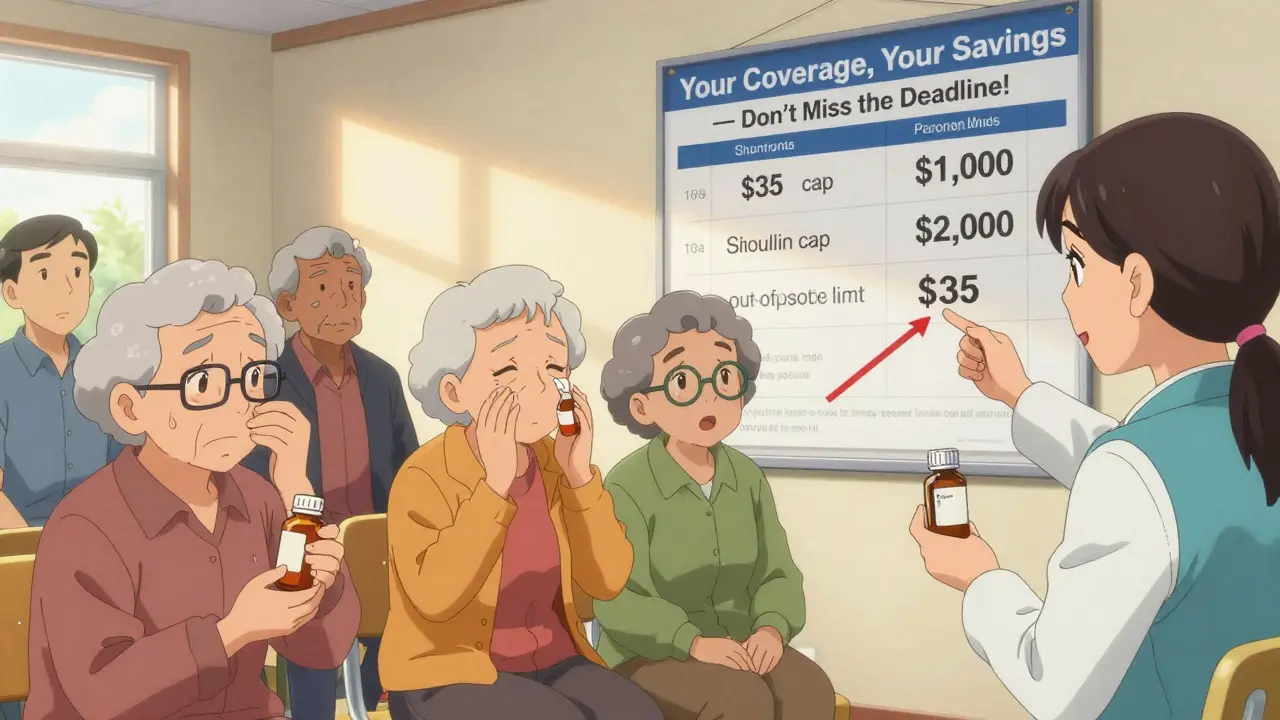

Watch for the New $35 Insulin Cap and the End of the Donut Hole

Thanks to the Inflation Reduction Act, 2025 is a turning point for medication costs. The infamous "donut hole" - the coverage gap where you paid full price after hitting your deductible - is now gone. You’ll never pay more than 25% of the cost for brand-name drugs in the catastrophic phase.

And insulin? You pay no more than $35 per month for each prescription, no matter what plan you’re on. This applies to all Medicare Part D and Medicare Advantage plans. But here’s the catch: not every plan automatically applies this cap. Make sure your plan lists insulin as a covered drug at the $35 cap. If it doesn’t, switch.

Same goes for other high-cost drugs. The law now caps out-of-pocket spending for certain medications at $2,000 per year starting in 2025. But this only applies if your plan complies. Double-check that your plan includes these protections.

Don’t Forget the Extras - And the Traps

Many Medicare Advantage plans offer extra benefits: dental, vision, hearing aids, gym memberships, even transportation to appointments. Sounds great - until you read the fine print.

Some plans offer $500 for dental, but only if you haven’t had a cleaning in the last two years. Others give you free hearing aids - but only if you buy them from their contracted vendor. Some supplemental benefits are only available to people with certain chronic conditions. If you’re dual-eligible (Medicare + Medicaid), 31% of Advantage plans have hidden eligibility rules that aren’t shown on the Plan Finder.

Ask yourself: Do you really need that gym membership if you can’t get to it? Is that $100 dental benefit worth it if you have to pay $150 just to get a cleaning? Focus on benefits that actually save you money on medications or health care - not extras you’ll never use.

When to Switch - And When to Stay

You don’t have to switch plans just because you can. If your current plan still covers all your meds at low cost, has your preferred pharmacy, and your doctor is still in-network - stick with it.

But if you’ve added a new medication, stopped one, or your pharmacy changed, it’s time to compare. The average beneficiary who actively compares plans saves $532 a year on prescriptions alone, according to Justice in Aging’s 2025 analysis. Some save over $1,200.

One woman in Florida switched from a $117/month Part D plan to a $21/month plan after discovering her two maintenance drugs were on Tier 2 in the new plan - not Tier 4. Her annual drug cost dropped from $1,800 to $450. She didn’t change doctors. She didn’t change pharmacies. She just looked.

What If You Miss the Deadline?

If you miss December 7, you’re locked in until next year - unless you qualify for a Special Enrollment Period (SEP). SEPs are rare. They’re for things like moving out of your plan’s service area, losing employer coverage, or qualifying for Medicaid. If you just forgot? Tough luck.

There’s a one-time window from January 1 to March 31 called the Medicare Advantage Open Enrollment Period (MAOEP). But this only lets you switch from one Medicare Advantage plan to another - or go back to Original Medicare. You can’t change your Part D plan during this time.

Bottom line: Don’t wait. Set a calendar reminder for October 1. Start gathering your meds. Review your ANOC by October 15. Use the Plan Finder by October 20. Make your decision by December 1. You’ll thank yourself in January.

Need Help? Free Counselors Are Waiting

You don’t have to do this alone. Every state has a State Health Insurance Assistance Program (SHIP). These are free, local counselors trained by Medicare. They don’t sell plans. They don’t get paid by insurers. They just help you understand your options.

Call 1-800-MEDICARE (1-800-633-4227) or visit shiptacenter.org to find your local counselor. In 2024, 68% of people who used SHIP found a better plan. And they did it without paying a dime.

What happens if I don’t change my Medicare drug plan during open enrollment?

If you don’t make any changes, your current plan will automatically renew for the next year. But that doesn’t mean it’s still the best option. Your plan’s premiums, drug formulary, pharmacy network, or cost-sharing could have changed - and you might be paying more than necessary. Many people end up paying hundreds more per year because they didn’t review their coverage.

Can I switch from Original Medicare to a Medicare Advantage plan during open enrollment?

Yes. During the Annual Open Enrollment Period (October 15-December 7), you can switch from Original Medicare (Parts A and B) to a Medicare Advantage plan (Part C) that includes prescription drug coverage. You can also switch between Medicare Advantage plans or drop your Medicare Advantage plan and go back to Original Medicare. All changes take effect on January 1.

How do I know if my medication is covered by a plan?

Use the Medicare Plan Finder tool on Medicare.gov. Enter your exact medication names, dosages, and frequency. The tool will show you which plans cover each drug, what tier it’s on, and how much you’ll pay out-of-pocket. Always double-check this - even if your plan covered it last year. Formularies change every year.

Is insulin really capped at $35 per month in 2026?

Yes. Under the Inflation Reduction Act, all Medicare Part D and Medicare Advantage plans must cap the cost of insulin at $35 per month for each prescription - no matter the dosage or brand. This applies to all insulin types and is effective for 2026 coverage. You won’t pay more than $35, even if your plan’s formulary lists it as a specialty drug.

What if my pharmacy is no longer in my plan’s network?

If your pharmacy drops out of your plan’s network, you’ll pay significantly more - sometimes double or triple - to fill your prescriptions. Check your plan’s pharmacy network before enrolling. Use the Medicare Plan Finder to search for your pharmacy by name. If it’s not listed as preferred, consider switching to a plan that includes your pharmacy or find a preferred pharmacy nearby. Some plans offer mail-order options with free shipping, which can be a good alternative.

Katherine Blumhardt

December 24, 2025 AT 13:27I just spent 3 hours on Medicare.gov and found out my insulin is now $35 instead of $80 😭 thank you thank you thank you to whoever wrote this

sagar patel

December 24, 2025 AT 23:37This is the most accurate guide I've seen on Medicare Part D changes. No fluff. Just facts. If you're on insulin or GLP-1s, you're already saving money by reading this.

Rick Kimberly

December 25, 2025 AT 19:26It is imperative to underscore the significance of reviewing the Annual Notice of Change and Evidence of Coverage documents prior to the December 7 deadline. Failure to do so constitutes a material risk to financial well-being, particularly for beneficiaries reliant on high-cost pharmaceuticals. The Centers for Medicare & Medicaid Services have demonstrated consistent annual formulary volatility, necessitating proactive engagement with plan comparisons.

Terry Free

December 27, 2025 AT 18:08Oh wow, so if I don't check my meds every year I'm just a dumbass who pays $1200 extra? Thanks for the guilt trip, genius. Also, why is everyone acting like CMS doesn't change stuff on purpose to screw people over? 😏

Lindsay Hensel

December 28, 2025 AT 01:30This is vital. Please, if you're reading this, pause everything. Open your mailbox. Find the ANOC. Look at your drugs. You have until December 7. Your health depends on this step.

Linda B.

December 28, 2025 AT 21:36Let me guess… the government made insulin $35 so they can track every single diabetic in America. And the Plan Finder tool? It’s feeding your data to Big Pharma. You think they care about your savings? They care about your biometrics. They’re already billing your insulin use to insurance algorithms. Don’t be fooled.

Christopher King

December 30, 2025 AT 12:50Everyone’s acting like this is some noble act of self-care but let’s be real - this whole system is a rigged casino. You’re supposed to spend weeks digging through jargon so they can profit from your confusion. And now they give you $35 insulin like it’s a gift? Nah. It’s a distraction. They know you’ll stop asking why your blood pressure med went from $12 to $98. This isn’t help - it’s theater.

Bailey Adkison

January 1, 2026 AT 10:21You say check the ANOC but most people don't even know what that acronym means. And the Plan Finder? It's useless if your meds are listed under generic names but your pharmacy uses brand. Also, why is nobody talking about how many plans still don't include mail-order for maintenance drugs? This guide is half-right.

Michael Dillon

January 2, 2026 AT 19:39My grandma switched plans last year and saved $800. She didn’t even know how to use a computer. She just called 1-800-MEDICARE and talked to a SHIP counselor for 12 minutes. If she can do it, you can too. Stop overcomplicating it.

Gary Hartung

January 3, 2026 AT 19:51Oh, so now we’re supposed to be ‘proactive’? As if the bureaucratic labyrinth wasn’t engineered to exhaust the elderly. The ‘Plan Finder’ requires 17 inputs, 3 separate verifications, and a willingness to trust a .gov site that crashed during the 2023 rollout. And you call this empowerment? It’s performative accessibility. The real solution? Single-payer. But no one wants to talk about that.

Ben Harris

January 4, 2026 AT 10:19My cousin got her meds through a church program for $5 a month. Why are we all just accepting this broken system? Why are we doing all this paperwork instead of demanding real reform? You’re all just playing the game. And the game is rigged.

Oluwatosin Ayodele

January 5, 2026 AT 10:42In Nigeria, we don't have Medicare. We pay out of pocket or go without. You have a system with formularies, subsidies, and a $35 insulin cap. You have tools. You have time. You have options. Stop complaining. Use them.

Jason Jasper

January 6, 2026 AT 17:22I read this last week. Printed the ANOC. Compared 3 plans. Switched to one with my pharmacy in-network. My monthly cost dropped from $147 to $52. No drama. Just done.

Mussin Machhour

January 7, 2026 AT 21:56Bro I was gonna skip this year but then my mom reminded me she’s on 5 meds. So I did the whole thing. Found a plan that covers her Ozempic at $30 instead of $110. She cried. I cried. We both ate tacos after. You guys need to do this. It’s not hard. Just do it.

Carlos Narvaez

January 9, 2026 AT 11:33The $35 insulin cap is irrelevant if your plan excludes it from the formulary. Always verify coverage - not just the cap. CMS allows this loophole. Many beneficiaries are unaware.