What Is a Drug Formulary? Complete Explanation for Patients

Dec, 8 2025

Dec, 8 2025

A drug formulary is a list of prescription medications that your health insurance plan covers - either fully or partially. It’s not just a catalog; it’s a tool that decides which drugs you can get at a lower cost, and which ones might cost you a lot more - or not be covered at all. If you’ve ever been surprised by a high copay for a medication you thought was covered, chances are it wasn’t on your plan’s formulary. Understanding how formularies work can save you hundreds or even thousands of dollars a year.

How Drug Formularies Are Built

Formularies aren’t made by random guesswork. They’re created by a team of doctors, pharmacists, and healthcare experts called a Pharmacy and Therapeutics (P&T) committee. These committees meet regularly to review new drugs, check clinical trial results, and compare prices. Their goal? To pick medications that work well, are safe, and offer the best value for money.This means a drug might be left off the list not because it doesn’t work, but because a cheaper, equally effective option exists. For example, if two blood pressure medications do the same job, but one costs $5 and the other costs $80, the cheaper one will likely be on Tier 1. The committee also considers safety data, side effects, and how often patients stick with the treatment - because a drug that’s hard to take won’t help if people stop using it.

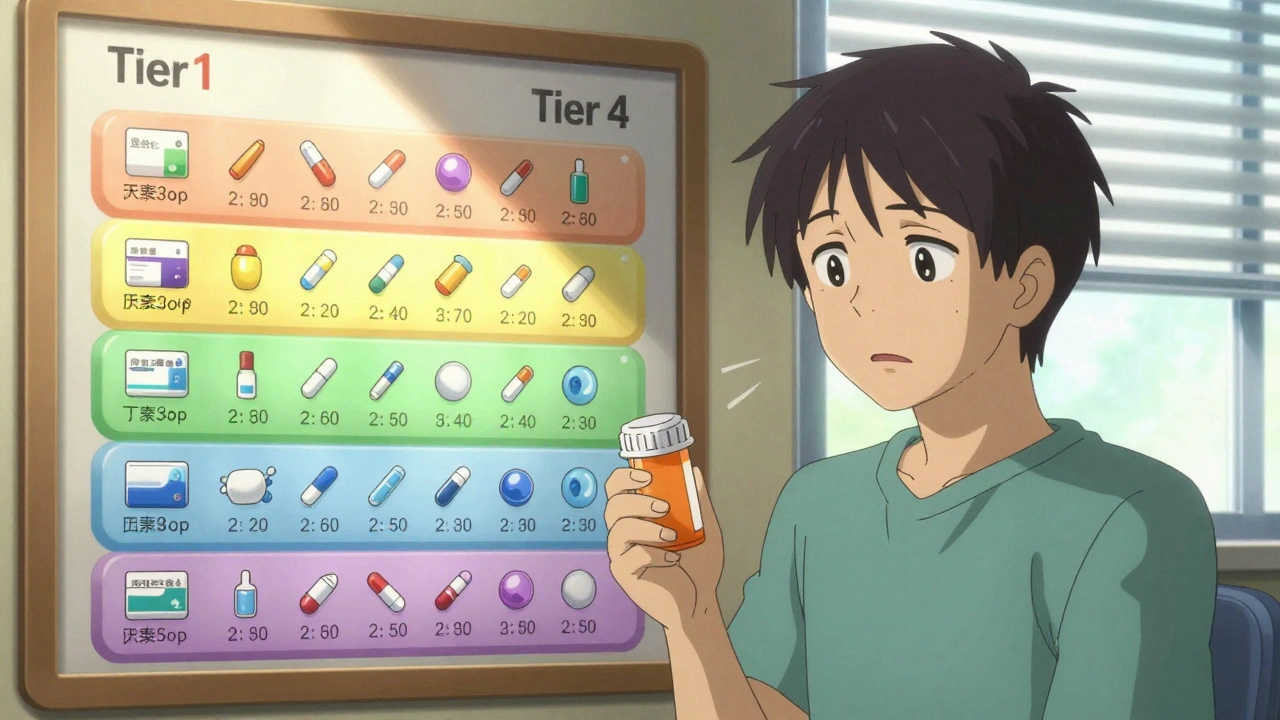

The Tier System: What It Means for Your Wallet

Most formularies use a tier system, usually with 3 to 5 levels. Each tier has a different cost for you. The lower the tier, the less you pay.- Tier 1: Generic drugs - These are copies of brand-name drugs that have the same active ingredients. They’re required by the FDA to work exactly the same way. Most plans cover these for $0 to $10 for a 30-day supply. Examples: metformin for diabetes, lisinopril for high blood pressure.

- Tier 2: Preferred brand-name drugs - These are brand-name medications your plan has negotiated a good price for. You’ll pay a higher copay - usually $25 to $50 - or 15% to 25% of the drug’s cost.

- Tier 3: Non-preferred brand-name drugs - These are brand-name drugs that aren’t on the preferred list. They cost more - often $50 to $100 per prescription - or 25% to 35% coinsurance. Your plan may require you to try a Tier 2 drug first.

- Tier 4: Specialty drugs - These are high-cost medications for complex conditions like cancer, multiple sclerosis, or rheumatoid arthritis. You might pay $100 to $200 per month, or 30% to 50% of the total cost. Some plans put these in a separate Tier 5.

Here’s the catch: the same drug can be on different tiers in different plans. A medication that’s Tier 2 in one Medicare plan could be Tier 3 in another. That’s why comparing formularies during open enrollment is so important.

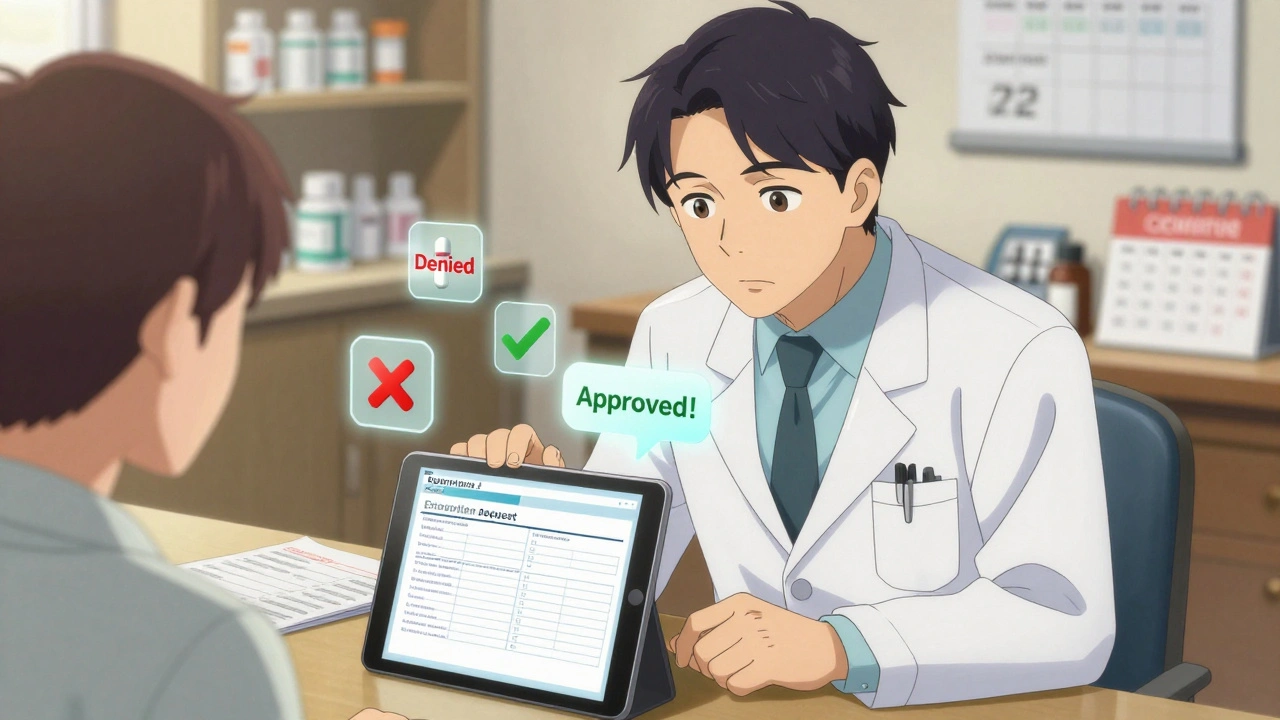

What Happens When Your Drug Isn’t on the List?

If your doctor prescribes a drug that’s not on your formulary, you’re in what’s called a “non-formulary” situation. That usually means one of two things: you pay full price, or your plan denies coverage entirely.But there’s a way out: a formulary exception. Your doctor can submit a request to your insurance company explaining why you need that specific drug - maybe because you had side effects from alternatives, or the cheaper options didn’t work. The insurance company has 72 hours to respond to a standard request, and just 24 hours if your condition is urgent. In 2023, about 67% of these requests were approved for Medicare Part D plans.

One patient on Reddit shared: “My insulin was taken off Tier 2 and moved to Tier 4. My monthly cost went from $30 to $180. I filed an exception - my doctor said I’d had bad reactions to every other insulin. Got approved in 48 hours. Saved my life.”

Formulary Changes Happen - Even Outside Open Enrollment

Many people think formularies only change once a year during open enrollment. That’s not true. Plans can update their formularies anytime - as long as they give you 60 days’ notice. A drug you’ve been taking for years could suddenly move from Tier 1 to Tier 3, or be removed entirely.According to the Patient Advocate Foundation, nearly 28% of formulary changes happen outside the annual enrollment period. That’s why it’s smart to check your formulary every time you refill a prescription - not just once a year.

Medicare beneficiaries can use the Medicare Plan Finder tool, updated every October, to compare formularies before switching plans. Commercial insurers usually post their full formulary documents on their websites. Look for a section called “Drug List,” “Formulary,” or “Preferred Drug List.”

What Are Prior Authorization and Step Therapy?

These are two tools insurers use to control costs - and they can be confusing.- Prior authorization means your doctor has to get approval from your insurance before the drug is covered. They’ll need to show medical reasons why you need this specific drug - not just any drug in the same class. This is common for expensive medications like biologics or certain cancer drugs.

- Step therapy - also called “fail first” - means you have to try one or more cheaper drugs before the plan will cover the one your doctor originally prescribed. For example, if your doctor prescribes a newer asthma inhaler, your plan might require you to try two older, generic inhalers first. If those don’t work, then you can move up.

Step therapy can be frustrating. One patient wrote: “I had to try three different pain meds before they’d cover the one my neurologist said was best. I was in pain for six weeks. I finally got approved - but it took three doctor visits and two appeals.”

How Formularies Affect Real People

A 2023 Kaiser Family Foundation survey found that 68% of insured adults check their formulary before filling a prescription. Why? Because the difference in cost can be huge.Take the diabetes drug metformin. In one plan, it’s a $5 generic on Tier 1. In another, the same drug is listed as a brand-name version on Tier 3 - costing $75. That’s a 15x price difference for the same medicine.

On the flip side, formularies can also protect you. A cancer patient on Facebook shared: “My immunotherapy drug cost $5,000 a month on the street. But my formulary covered it at a $95 copay. I didn’t have to choose between treatment and rent.”

That’s the balance: formularies save money for everyone by steering people toward cost-effective drugs - but they can also create barriers if they’re too strict.

What You Can Do Right Now

You don’t have to guess or wait for a surprise bill. Here’s what to do:- Find your plan’s current formulary. Look on your insurer’s website or call customer service.

- Search for every medication you take - including over-the-counter drugs your doctor recommended.

- Note the tier and any restrictions (prior auth, step therapy, quantity limits).

- If something’s off-formulary, ask your doctor: “Is there a similar drug on Tier 1 or 2?”

- During open enrollment (October 15-December 7 for Medicare), compare formularies across plans. Don’t just look at premiums - look at drug costs.

- Keep a printed or digital copy of your formulary. Update it every time you refill a prescription.

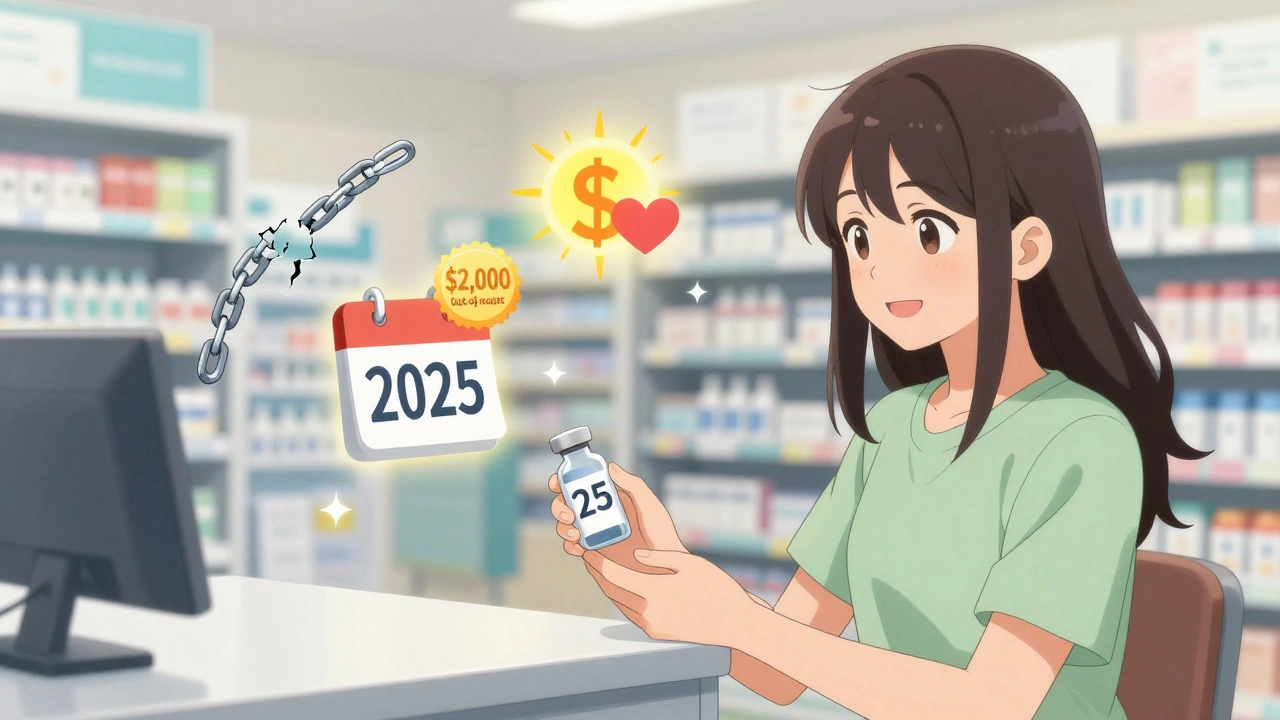

What’s Changing in 2024-2025

New rules are making formularies a little more patient-friendly:- Insulin cap: Since 2023, Medicare Part D plans must charge no more than $35 per month for insulin.

- Out-of-pocket cap: Starting in 2025, Medicare beneficiaries will pay no more than $2,000 a year for all covered prescription drugs - no matter how many they take.

- Biosimilars: These are cheaper versions of complex biologic drugs. More are being approved - 43 as of mid-2024 - and formularies are starting to favor them.

- AI tools: By 2027, insurers may use AI to recommend personalized drug choices based on your health history, genetics, and past responses - all while keeping costs down.

These changes mean formularies are becoming more transparent and more focused on outcomes - not just cost.

Final Thought: You Have Power

A drug formulary isn’t something you just accept. It’s a system you can navigate - if you know how. Your doctor can help. Your pharmacist can help. And your insurer must respond when you ask for an exception.Don’t assume your medication is covered. Don’t assume your plan won’t change. Check your formulary every time you get a prescription. Ask questions. File exceptions when needed. You’re not just a patient - you’re a key part of the decision-making process.

What is a drug formulary?

A drug formulary is a list of prescription medications that your health insurance plan covers. It’s organized into tiers that determine how much you pay out of pocket. The formulary is created by a team of doctors and pharmacists to balance effectiveness, safety, and cost.

Why does my insurance only cover certain drugs?

Insurance plans use formularies to manage costs. They negotiate lower prices with drug makers for medications they cover. By encouraging the use of cheaper, equally effective drugs - like generics - they reduce overall spending. This helps keep premiums lower for everyone.

Can I get a drug that’s not on my formulary?

Yes, but you’ll likely pay full price unless you request a formulary exception. Your doctor can submit a letter explaining why you need that specific drug - for example, if other drugs caused side effects or didn’t work. Approval rates for exceptions are around 67% for Medicare plans.

How often do formularies change?

Formularies are updated annually, usually on January 1. But they can also change mid-year with 60 days’ notice. About 28% of changes happen outside the open enrollment period, so always check your formulary before filling a prescription.

What’s the difference between Tier 1 and Tier 2 drugs?

Tier 1 drugs are usually generic medications and cost the least - often $0 to $10 per prescription. Tier 2 drugs are brand-name medications that your plan has negotiated a good price for. You’ll pay more - typically $25 to $50 per prescription - but less than for non-preferred brands on Tier 3.

Do all insurance plans have the same formulary?

No. Every plan - even within the same insurer - can have a different formulary. A drug on Tier 2 in one Medicare Part D plan might be Tier 3 in another. That’s why comparing formularies during open enrollment is critical when choosing a plan.

What is step therapy?

Step therapy, or “fail first,” means your insurance requires you to try one or more cheaper drugs before covering the one your doctor prescribed. For example, you might have to try two generic pain relievers before getting coverage for a stronger prescription. This is common for expensive medications.

How do I find my plan’s formulary?

Check your insurer’s website - look for “Drug List,” “Formulary,” or “Preferred Drug List.” Medicare beneficiaries can use the Medicare Plan Finder tool. You can also call customer service or ask your pharmacist for a copy. Always verify the formulary at the time of your prescription, not just once a year.

Next Steps

If you’re on Medicare, mark your calendar for October 15 to December 7 - that’s open enrollment. Use the Medicare Plan Finder to compare formularies. If you have private insurance, log in to your member portal and download your current formulary. Print it or save it on your phone.If you’re taking a medication that’s expensive or hard to get, talk to your doctor. Ask: “Is there a similar drug on Tier 1 or 2?” If your plan denies coverage, ask for a formulary exception. Don’t give up - many approvals happen on appeal.

Remember: formularies exist to help you save money - but only if you know how to use them. Stay informed. Stay proactive. Your health - and your wallet - will thank you.

Nikhil Pattni

December 9, 2025 AT 07:06Look, I’ve been on 7 different insurance plans in the last 5 years and let me tell you - formularies are a goddamn maze. One month metformin’s $5, next month it’s $75 because they swapped tiers. No warning. No email. Just your pharmacy saying ‘sorry, we can’t fill that’ like you’re the problem. And don’t even get me started on step therapy - I had to fail on 3 pain meds before they’d give me the one my neurologist prescribed. I was in agony for 8 weeks. And yeah, I got approved eventually, but only after 3 calls, 2 letters, and one very angry voicemail to the CEO’s direct line 😤

precious amzy

December 11, 2025 AT 01:53One cannot help but observe the deeply problematic epistemological framework underpinning formulary design: it reduces complex human physiology to a cost-benefit algorithm, thereby commodifying health itself. The P&T committee, ostensibly a bastion of clinical rationality, functions as a neoliberal technocracy - privileging fiscal efficiency over therapeutic individuality. One wonders: if a drug saves a life but costs $200/month, is it not morally superior to a $5 generic that merely suppresses symptoms? The formulary, then, is not a tool of care - but a mechanism of social control.

Courtney Black

December 12, 2025 AT 23:57People don’t realize how much this affects mental health meds. I’m on an SSRI that got bumped to Tier 4. Went from $12 to $140. I had to choose between my medication and groceries. I cried in the pharmacy aisle. No one talks about this. But it’s real. And it’s killing people slowly.

Richard Eite

December 14, 2025 AT 07:48Gilbert Lacasandile

December 16, 2025 AT 04:10I just wanted to say thank you for writing this. I’ve been struggling to explain formularies to my mom, and this broke it down so clearly. I printed it out and gave her a copy - she’s 72 and on Medicare, and she finally gets why her insulin cost jumped. You made something confusing feel manageable. Really appreciate it.

Lola Bchoudi

December 17, 2025 AT 16:19From a clinical pharmacy standpoint, tiered formularies are an evidence-based strategy to optimize therapeutic outcomes while containing expenditures. The P&T committee’s deliberative process integrates pharmacoeconomic modeling, real-world evidence, and adherence metrics - all aligned with ASCO and ISPOR guidelines. Patients often misinterpret formulary restrictions as arbitrary, when in reality, they reflect a structured, iterative optimization of population-level outcomes. Proactive engagement with prior authorization protocols and step therapy pathways is not merely administrative - it’s a critical component of patient-centered care delivery.

Morgan Tait

December 18, 2025 AT 20:59Ever wonder why your insulin is suddenly $180? It’s not just the insurance - it’s the Big Pharma lobby. They’ve been buying politicians since the 90s. The $35 insulin cap? That’s a band-aid. The real villains are the middlemen - PBMs - who take 20% of every dollar spent and never show their books. And guess what? They’re all headquartered in Delaware. Meanwhile, you’re choosing between insulin and rent. Wake up. This isn’t healthcare. It’s a rigged casino. And we’re all losing.

Darcie Streeter-Oxland

December 20, 2025 AT 03:33It is regrettable that the article, whilst informative, fails to adequately address the ethical implications of tiered pharmaceutical access within a privatized healthcare system. The normalization of cost-based drug allocation, even when justified by clinical efficacy metrics, constitutes a de facto rationing mechanism that disproportionately impacts low-income populations. A more rigorous discourse ought to be engaged, rather than merely instructing patients on navigational tactics within a fundamentally unjust architecture.

Chris Marel

December 21, 2025 AT 08:01This is actually super helpful. I’m from Nigeria and we don’t have insurance like this - but my cousin in Texas just told me she can’t afford her asthma inhaler. I showed her this. She cried. Thank you for making something so complicated feel human.

Evelyn Pastrana

December 22, 2025 AT 14:45So let me get this straight - we’re supposed to be grateful that we can pay $180 for insulin instead of $1800? That’s the win? 😂

Arun Kumar Raut

December 24, 2025 AT 06:13Hey, I’m from India and we don’t have formularies like this - but I’ve seen how expensive meds are here too. The real issue isn’t the list - it’s that no one teaches you how to fight for your meds. Your doctor should be your ally, not your gatekeeper. Talk to your pharmacist. Ask for samples. Call your insurer. You’re not being annoying - you’re being smart.

Carina M

December 25, 2025 AT 22:50The author’s conflation of cost-efficiency with patient welfare reveals a troubling technocratic bias. One cannot help but note the absence of any critical engagement with the pharmaceutical industry’s monopolistic pricing practices - a glaring omission that renders this entire exposition a sanitized corporate brochure. Formularies do not 'save money' - they externalize suffering onto vulnerable populations. To call this 'empowerment' is a euphemism for resignation.

Tejas Bubane

December 27, 2025 AT 11:52Formularies are a joke. The fact that you need to file an exception to get a drug your doctor prescribed proves the system is broken. And don’t even get me started on how they drop drugs mid-year just to make you panic and switch plans. It’s predatory. And the P&T committees? They’re just pharma puppets with MDs after their names. Wake up. This isn’t medicine. It’s corporate espionage disguised as healthcare.

Ajit Kumar Singh

December 28, 2025 AT 12:09Bro this is so true I was just on the phone with my insurance for 45 minutes because they said my blood pressure med wasn't covered but my doctor said it was on the list and then I found out they updated it 2 weeks ago and didn't tell anyone and now I have to wait 7 days for an exception and I'm out of pills and I'm not even mad anymore I'm just tired